-

Know-how

Know-howNavigating Self Assessment: A Guide for Sole Traders and Landlords

Curious about the tax essentials for sole traders and landlords? Learn how to navigate self-assessment effortlessly, from registering with HMRC to ensuring a smooth financial journey for your business endeavors.

Feb 07, 20241351 -

Banking

BankingUnderstanding Student Loan Default and Navigating Recovery

Struggling with student loan default? Uncover practical strategies and essential insights to reclaim financial stability and bounce back from the challenges.

Feb 07, 20246005 -

Banking

BankingBeyond Conventional: Versatile Solutions for Your Financial Needs with Personify Financial

Explore the ins and outs of Personify Financial Personal Loans in this straightforward review. Learn about eligibility, application process, and if it's the right fit for you.

Feb 07, 20243808 -

Banking

BankingExploring Citibank Personal Loans: A Detailed Review

Are Citibank Personal Loans the right fit for your financial goals? Explore our detailed review to uncover the features, pros, and cons, helping you make informed decisions tailored to your needs and preferences.

Feb 06, 20242970 -

Know-how

Know-howManaging Finances in Small Business: Practical Tips and Strategies

Tips for small business financial management. Strategies for maintaining healthy business finances.

Feb 06, 2024500 -

Banking

BankingAmEx Gold vs. Platinum: Which Is Better for Your Business?

Wondering which American Express card is right for your business? Uncover the perks of AmEx Gold and Platinum to find the perfect fit for your financial and travel requirements.

Feb 05, 20247268 -

Investment

InvestmentA Practical Guide to Nike Stock Investment and Risk Navigation

Curious about investing in Nike stock? Uncover the why, how, and potential risks in this guide, empowering you with insights for a confident and human-centered investment journey.

Feb 05, 20244719 -

Know-how

Know-howEasy Steps to Open a Bank Account for Kids

Learn how to open a bank account for kids in five easy steps. A guide for parents.

Feb 05, 20246306 -

Taxes

TaxesWhat Is 501(c)? Learn in Detail

Nonprofit organizations, including private foundations, public charities, and private foundations operating for profit, can qualify for federal tax exemption under section 501(c)(3) of the US Internal Revenue Code. The Internal Revenue Service of the United States Department of the Treasury oversees and controls the program.

Feb 04, 20249260 -

Banking

BankingHow to Find and Compare the Best joint personal loans in 2024

Want to secure the best joint personal loans in 2024? You've landed just right! Read this article to secure the one that suits your needs this year!

Feb 04, 20241116 -

Know-how

Know-howGeneral Liability vs. Professional Liability Insurance: A Comparative Analysis

Discover the critical differences between General and Professional Liability Insurance, understand their coverage details, and learn how to choose the best insurance for your business.

Feb 02, 20241640 -

Banking

BankingAll About U.S. Bank Altitude Reserve Credit Card

If the U.S. Bank Altitude Reserve were a young basketball player, it would be like a short child with big dreams. The card has several beautiful features, but it could be a more apparent winner when compared to the alternatives. Check out the numbers for yourself. Your card will earn 3 points per dollar on eligible travel expenditures, plus 5 points per dollar on prepaid hotel, vehicle hire, and mobile wallet transactions.

Jan 28, 20241133 -

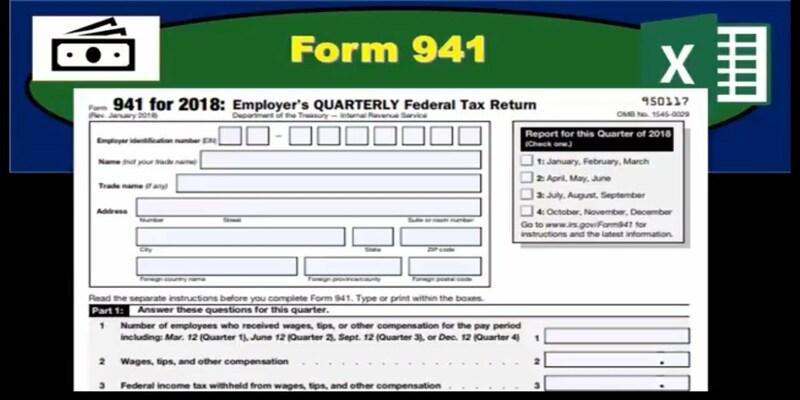

Taxes

TaxesWhat You Need To Know About IRS Form 941

A crucial tax form for businesses is IRS Form 941, the Employer's Quarterly Tax Form. Most U.S. employers are obliged to submit quarterly federal tax returns, except for individuals who only do so once a year. Businesses with employees are required to submit federal withholdings from employees on Form 941.

Jan 27, 20241623 -

Banking

BankingThe Best Review of Hilton AmEx 2022

If you often stay at Hilton hotels and are looking for a credit card that doesn't charge an annual fee but still comes with a substantial introductory bonus, consider the Hilton Honors card from American Express. In addition to the free Hilton Honors Silver membership and no annual charge, this card provides a great rewards rate on all transactions, not only those made at Hilton. For costs, see here.

Jan 23, 2024775 -

Banking

BankingAll About the Best Bank CD Rates

The most excellent certificates of deposit (CDs) can be found at banks and credit unions that offer above-average annual percentage yields (APYs) and dividend rates. Not only do they have manageable minimum deposit requirements and advantageous compounding schedules, but they also maintain respectable interest rates. The best digital and customer service experiences are the norm for these companies.

Jan 21, 20247466 -

Taxes

TaxesDifferent Ways to Protect Your Inheritance From Taxes

Be wary of the potential for hefty taxes on retirement account distributions if you fail to properly prepare for their receipt by your heirs. Although your beneficiaries won't owe taxes until they withdraw money from their accounts, they will owe taxes on a set amount each year from their accounts

Jan 15, 20242761 -

Mortgages

MortgagesWhat Is A Home Equity Conversion Mortgage: A Complete Guide

The HECM (Home Equity Conversion Mortgage) is a way for those 62 and up to cash out some of their home equity to help fund their retirement.

Jan 08, 20243999 -

Mortgages

MortgagesFinance Options For People With Average Credit

People seek out personal loans when they need more financial assistance, such as when trying to consolidate high-interest credit card debt or save up for a significant purchase. Online payday loans often have no collateral requirements, no lengthy application processes, and instantaneous funds deposits. However, if you don't have a stellar credit history, you may need help being approved

Jan 06, 20242978 -

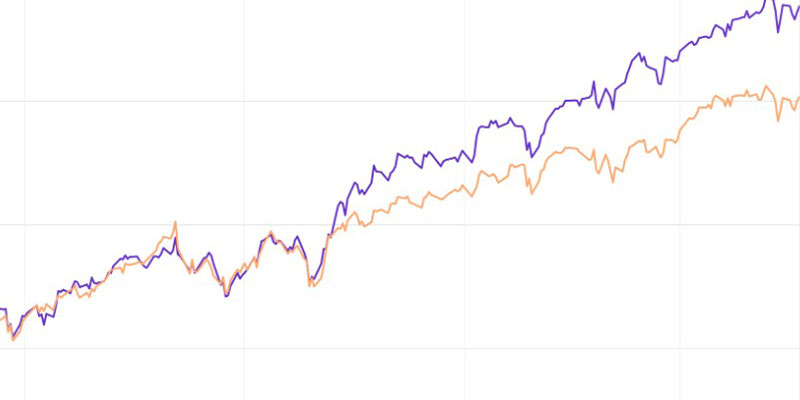

Investment

InvestmentWhat You Should Know Before Choosing Actively Managed Funds or Passive Investing

A portfolio manager and perhaps other "active participant" must take an active role in active investing. Less active trading is characteristic of passive investment, which often entails purchasing index funds and perhaps other types of mutual funds. Active and passive investing has advantages, but passive investing has attracted more capital. Passive investments have often generated higher returns than their active counterparts. For the first time in quite some time, active investing has gained traction, especially in times of market turmoil.

Jan 01, 20247574 -

Investment

InvestmentHow to Invest in Wide-Moat Stocks?

Find stocks with a broad moat by comparing a company's financial performance to that of other companies

Dec 25, 20233123 -

Banking

BankingWhy Bankruptcy Stay on Your Credit Report

Capital One does not offer, recommend, or guarantee any of the above-mentioned third-party products, services, information, or suggestions. All trademarks and service marks referenced herein belong to their respective owners

Dec 22, 20237048 -

Investment

InvestmentOutstanding Equal-Weight ETFs

The S and P 500® Equal Weight Index serves as the foundation for the Invesco S and P 500® Equal Weight ETF (Fund) (Index). At least 90% of the Fund's total assets will be allocated to securities that make up the Index. The S and P 500® Index's stocks are equally weighted in the index. Each quarter, the Fund and the Index are rebalanced.

Dec 18, 2023856 -

Banking

BankingOpening a Store Credit Card to Buy Furniture a Bad Idea

Store credit cards, ironically, force consumers to make all of their purchases from a single retailer or chain. However, the interest fees associated with a retail credit card are higher than those of a standard, universally accepted credit card. Therefore, it is in your best interest to compare prices. Don't stick with one store unless you're sure you're getting the greatest idea

Dec 09, 20239967 -

Mortgages

MortgagesSimple Steps To Clean Your Carpet In 2023

Beautiful as they may be, your rugs deteriorate rapidly due to the outside. Pet paws, urine, feces, spilled beverages, dust, furniture, feet, and shoes are all examples. If you want your carpet to keep looking velvety for as long as possible, you must know the best ways to clean it

Dec 05, 20239996 -

Mortgages

MortgagesUnderstanding Credit Builder Loans

Get to know how do Credit builder loans work and make them work for you to build or rebuild your credit history and improve your financial portfolio.

Dec 02, 20237840 -

Mortgages

MortgagesExplain: What Is a Mortgage Constant?

Mortgage constants measure the yearly cost of servicing a loan as a fraction of the principal. The annual financial outlay required to keep up with mortgage payments can be estimated using the mortgage constant. Debt service ratios are determined by dividing annual loan payments by the principal loan amount.

Nov 27, 20232175 -

Investment

InvestmentHow to Use Your IRA to Purchase Real Estate

Real estate is a long-term, solid investment. It may also help broaden a portfolio rich in equities and bonds. Real estate investment doesn't need a mortgage. Your IRA may have all the money you require. There are various IRA real estate investment methods. These include purchasing a property directly or real estate firm shares.

Nov 27, 20239842 -

Investment

InvestmentState Guaranty Fund

You've received a letter from the state's insurance commissioner, and the information isn't positive. Your company's auto insurer is bankrupt! The letter is particularly alarming since you made an additional claim just one week ago. What do you do? Don't panic! The state's insurance Guaranty Fund will most likely pay your claim.

Nov 26, 20235275 -

Banking

BankingReview of the Expedia Reward Card

Are credit cards with perks worth it? Yes, in the majority of situations, provided you don't have a balance and the yearly fee, if applicable, is less than the value of the points you receive annually. It never hurts to be aware of how to maximise the benefits of your credit card's rewards.

Nov 21, 20237876 -

Taxes

TaxesWhat Is the IRS, and What Do They Do?

The Internal Revenue Service (IRS) of the United States government is in charge of tax collection and enforcement (such as the wash sale rule Internal Revenue Service (IRS) was established by President Abraham Lincoln in 1862, and it is the federal government department that collects individual income and employment taxes. The IRS is also in charge of corporate, excise, and gift taxes, which are also handled by them.

Nov 19, 20239044 -

Investment

InvestmentAuthorized Shares vs. Outstanding Shares: An Overview

The maximum number of shares a company can issue to investors is the authorized share. This is determined in the articles of incorporation. The actual shares investors have purchased or issued from the authorized share pool are called outstanding shares.

Nov 19, 20233040 -

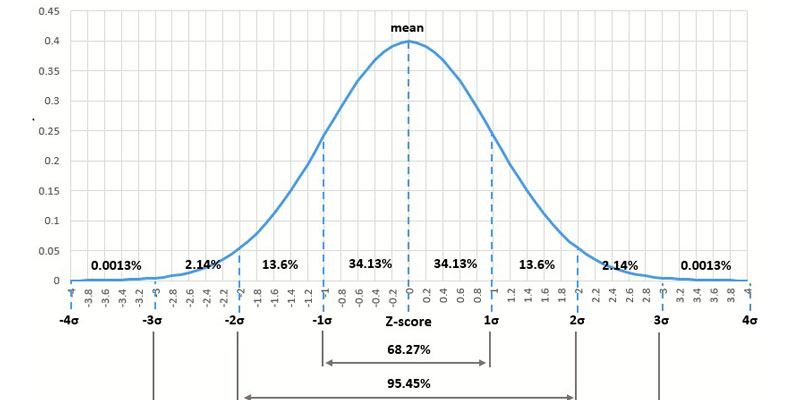

Banking

BankingAll About a Z-Score

Z-score also has limited utility for startups because it takes profits history into account. These businesses will have a low rating regardless of how healthy their finances actually are. In addition, the Z-score doesn't consider a company's cash flow. Instead, the ratio of net working capital to assets provides merely a clue at this

Nov 12, 20236780 -

Investment

InvestmentBuy Stock With Insiders

The SEC's Edgar database gives the general public unrestricted access to any and all filings relating to the purchasing and selling of stock shares by company insiders. Many websites that provide information on finances have databases of insider purchases that are easy to use.

Oct 30, 20235697 -

Banking

BankingBusiness Credit Cards without Personal Guarantee

There aren't a lot of options for No-personal-guarantee business credit cards, but you can find one. Find out how to receive a business card with no personal guarantee.

Oct 30, 20239035 -

Banking

BankingWhat Is A Credit Union With Shared Branches?

When a credit union is part of a larger network, its members may use any branch to withdraw or transfer funds. If you need access to your money when traveling, working, or attending school in an area where your home credit union does not have branches, consider joining the shared branch credit union. Shared branching allows the same financial transactions as the customer's home branch. Here's a deeper look at what you may need help accomplishing.

Oct 27, 20236472 -

Banking

BankingNo Credit Score: An Overview

You do not have a credit score, but you also do not have a credit score of zero if you do not have a credit history.

Oct 27, 20236245 -

Mortgages

MortgagesHow To Pay Off $100,000 In Student Loans

It's rare for students to owe six figures in education loans. Consequently, the regular, 10-year federal payment schedule could not be suitable when you're looking at a student loan total of $100,000 period of at least. With that debt, the minimum monthly payment would be over $1,000. A new strategy for paying off student loans could help you save on interest, reduce your monthly payments, or accomplish both, all while reducing the total amount of time it takes to eliminate the debt. Assuming you can comfortably make regular payments, the least expensive plan is likely the best option. Learn about your alternatives for retiring student loans worth $100,000 and make an informed decision.

Oct 18, 20235442 -

Banking

BankingWhat Is The Purpose Of A Credit Card Hold?

It would help if you inquired about the credit card hold policy and the amount to be held when making a hotel or auto rental reservation. Make sure you know your credit card's spending limit and balance before you leave the house. It is customary to use the same credit card when paying for a hotel stay or rental vehicle, so check your balance to ensure you have enough money. You'll still have a backup if one of your cards is denied. When you've paid your last payment at the hotel or returned the rental vehicle, you should request that the hold be lifted promptly. If they don't, press them for a specific timeframe for removal

Oct 15, 20236909 -

Investment

InvestmentA Detailed Comparison Between: Full-Service Vs. Discount Brokers

Discount brokers are stockbrokers who execute buy and sell orders at lower commission rates than full-service brokers. In contrast to a full-service broker, a discount broker does not do any research or analysis on a client's behalf. Before the development of more convenient methods of communication, only those with a substantial annual income could afford to hire a broker and gain access to the stock market.

Oct 12, 20232048 -

Taxes

TaxesDefine Tax Advisor: Who Are They and What Do They Do?

with the assistance of a tax professional, you may reduce your tax burden, maximize your use of tax deductions, and maintain control over your financial reporting requirements. Tax advisors, who have more training and experience than the average tax preparer, may assist with your estate planning, charitable contributions, and other intricate tax matters. These experts often have a background in finance and accounting.

Oct 09, 20232806

-

Mortgages

MortgagesWhat Is the Public Debt, and When Is It Excessively High?

Feb 08, 2024 -

Banking

BankingThe Ultimate Guide to Harley-Davidson Credit Cards and Top Things You Should Know About it

Feb 08, 2024 -

Taxes

TaxesSelf-Employed Life Insurance Choices in 2024

Feb 08, 2024 -

Know-how

Know-howThe Ultimate Guide to Choosing the Best Lender Between OneMain and Mariner Loans

Feb 08, 2024 -

Banking

BankingNavigating the Thrills: Understanding the NASCAR Credit Card

Feb 07, 2024