A value's distance from the mean of a set is quantified by its Z-score, a quantitative metric. Z-score is expressed as several standard deviations away from the mean. When the Z-score for a data point is 0, the value for that point is the same as the value for the mean.

One standard deviation from the mean corresponds to a Z-score of 1.0. For Z-scores, a positive value indicates that the score is higher than the mean, while a negative value indicates that the score is lower than the mean.

Z-scores, measures of the variability of observation, are used by investors to get a sense of the market's volatility. The Altman Z-score is another common name for the Z-score. Z-Scores are used in statistics to determine how far a given score is from the group average.

A Z-score can tell a trader whether or not a given number is average for a given data collection. With a Z-score below 1.8, a company's financial stability is questionable, while a score closer to 3 indicates a healthy financial condition.

The Theory Behind Z-Scores

Z-scores show statisticians and investors whether or not a given score is typical for a given data collection. Z-scores also allow analysts to transform scores from different data sets into scores that are more directly comparable to one another.

New York University professor Edward Altman created the Z-score algorithm in the late 1960s to help investors quickly and easily assess a company's likelihood of filing for bankruptcy. In reality, Altman's Z-score algorithm gave investors insight into a company's financial health as a whole.

Altman kept revisiting his Z-score as time went on. Altman studied a total of 86 failing businesses between the years 1969 and 1975. Between 1976 and 1995, he kept tabs on 110 different businesses. Finally, he assessed 120 more businesses between 1997 and 1999. From his research, we learn that the Z-score is accurate within the range

When Altman revised the Z-score in 2012, he called it the Altman Z-score Plus. It's helpful in assessing large and small businesses, domestic and international, manufacturing and service-oriented. The probability of bankruptcy for a publicly traded firm can be estimated using the Z-score, which results from a credit-strength test. The Z-score is derived from five significant financial ratios published in the 10-K report every year. The Altman Z-score is derived as follows:

Comparing Standard Deviation with Z-Scores

Any data collection's variability can be captured by calculating its standard deviation. The standard deviation is computed by first finding the variance of the data from the mean. Next, we square the differences, add them, and take the mean—the variation results from this. The variance's square root is the standard deviation.

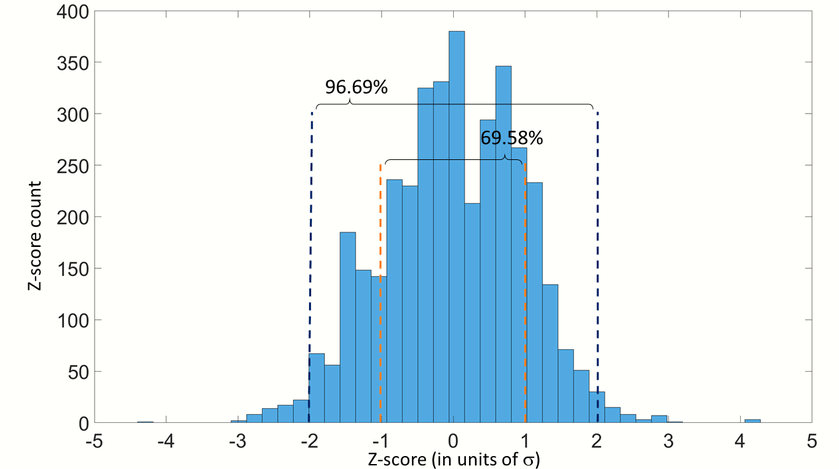

However, the distance a data point is from the mean is measured using the Z-score in terms of standard deviations. The Z-score takes a negative value for data much lower than the mean. Z-scores between -3 and 3, indicating values within three standard deviations of the mean, account for over 99 percent of all values in most extensive data sets.

Problems with Z-Scores

Careful calculation and interpretation of the Z-score are required. The Z-score, for instance, is not safe from questionable bookkeeping. The Z-score relies on the reliability of the information used to calculate it. This can be an issue for troubled organizations that may try to hide or distort their financial situation.

Finally, if a corporation takes one-time write-offs, the Z-score can change from quarter to quarter. Such occurrences can alter the final tally and provide the erroneous impression that a business is in danger of going bankrupt.

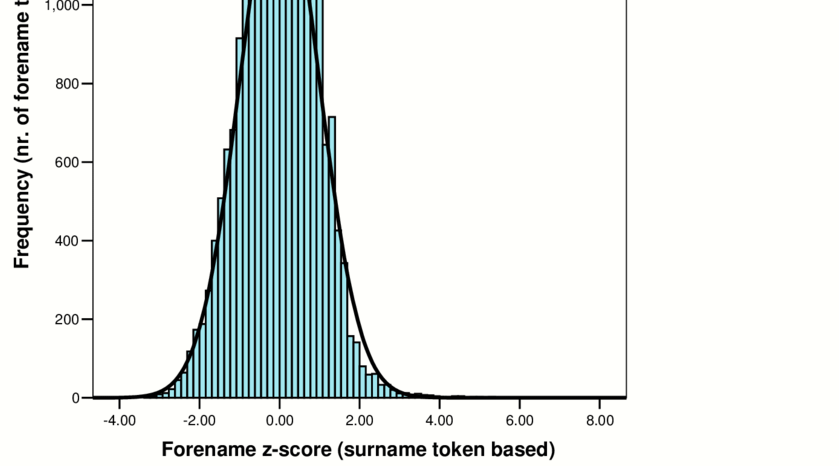

Using the normality test graph or the x and y, you can see that a z-score of 2.0 indicates "above average." For example, if you know a person who weighs 240 pounds and whose z-score is 2.0. Because of this weight's high position on the standard distribution curve, you already recognize that such a BMI of 2.0 is over standard; yet, you're curious about how considerably above average this weight is.

At the curve's null point, the z-score is also 0. Z-scores more than or equal to the mean are considered positive, while those smaller than or equal to the mean are considered harmful. Examining the z-table for one's score reveals what proportion of the population falls inside a given range. There is a.9772 (or 97.72%) noted in the table below for a z-score of 2.0. The identical score (2.0) above the standard distribution curve equals 97.72%.